#18: WSB is a social Dot Collector

WSB have managed to create a "believably weighted idea meritocracy" like Bridgewater Capital– except it surfaces trading ideas that are both funny and profitable.

Welcome readers old and new. This is one of Thomas Hollands’ notes in his search for ideas which are surprisingly general, or generally surprising. You can find all past issues here.

GameStonk has been all over the news this week. I'll spare you the recap– but if you've been living under a rock read Alex Danco's explainer.

I try not to write about current events, but I've been thinking a lot about this one. When I read this my ideas crystallised:

WSB have created a believability-weighted decision making process to rival one of the best hedge funds of all time: Bridgewater capital. Let me explain.

How Bridgewater decides

Hedge funds make money by making the right decisions at the right time. No financier has been more publicly interested in decision making than Bridgewater founder Ray Dalio: he's obsessed with systematising the decision making processes within his company.

After decades of experimentation, he settled on a decision making process he calls "an idea meritocracy with believability weighted decision making". First, I'll explain what this mouthful means. Then, I'll explain how WSB's decision making process is startlingly similar.

Normal decision making

Groups of people classically make decisions in two ways: autocratically or democratically.

In an autocratic process, the person with the most power (lets call him the "King"), decides what is best for everyone.

Autocratic processes are usually fast. When the King understands the problem-situation– the context within which the decision takes place– he is likely to make a good decision. If the King lacks the context to understand a given decision, he is likely to make a poor decision. And since one person can only understand so many problem-situations, this likelihood is quite high.

In a democratic process, everyone gets a vote, and a decision is made by consensus– usually majority rule.

Democratic processes are usually slow. Since most people don't understand the problem-situation, and you need at least 50% agreement to go ahead, it takes a lot of deliberation to get everyone on the same page. And unless the group have good processes to surface information and context relevant to the decision, the group is likely to make poor decisions too.

Both processes are suboptimal. The King is likely to make bad decisions about the many things he doesn't understand. And the democratic crowd is vulnerable to hijacking by charismatic hucksters acting in their own interest, instead of the interest of the whole group.

Believability weighted decision making

It makes sense to believe more competent decision makers more than less competent decision makers.

According to Dalio, the most believable decision makers have 1) a demonstrated track record making similar kinds of decisions correctly before and 2) can explain the cause-and-effect relationships behind their conclusions about the decision in question.

Provided everyone agrees on how to determine whether someone is believable*, believability weighted decision making can combine the speed and alignment of autocracy with the information surfacing power of democratic debate.

To determine whether someone is believable, you need 1) good mechanisms to qualify someone's track record on a decision, and 2) surface their own beliefs about future decisions. Most places don't have this– but Bridgewater does. And WSB does too.

To qualify someone's track record, you need to make that track record publicly legible– everyone should be able to see it and come to their own conclusions about it.

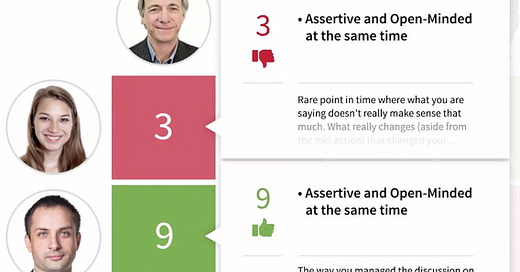

Bridgewater does this with a tool they call the "Dot Collector": basically, everyone can vote on everyone else's comments, opinions, and decisions, in real-time, all the time, at the company. They can rank their colleagues along many different criteria. It looks like this:

Eventually, the dots stack up, to form a mosaic of a person's strengths and weaknesses, as rated by their colleagues. Because the dots are all public, they create common knowledge: Amy knows what Bob thinks about Carla. This means, along a given competency, it's obvious who the most competent and least competent people. Everyone can see what everyone else thinks.

Dalio calls Bridgewater an "idea meritocracy"– anyone can put forward their ideas, and people will believe them in proportion to how well explained they are, and how believable the explainer is. Most meetings are open debates, which allow everyone's beliefs about future decisions to be surfaced and discussed– before a consensus is reached, people "disagree and commit", and capital allocation decisions are made.

Bridgewater allocates capital in proportion to how "sure" they are about the decision they've made– as measured by their believability weightings.

The WSB version

Reddit has a less elegant, but nearly as effective, way to make someone's track record legible: Upvoting, commenting, and gilding.

When someone states their opinion, say a bet on a business whose main source of revenue is selling used video games, you can upvote, comment, and reward them with awards, in proportion to how compelling you find their analysis.

Everyone can vote on what everyone else says. The posts with the most compelling analysis rise to the top of the forum. The unintelligible ones languish in obscurity.

Of course, Redditors don't always vote for things based purely on who has the ideas most likely to be true. They reward posts in proportion to how compelling they are– which is a combination of how funny an idea is, and how much money you can make out of it.

Unlike the Dot Collector, you can't see who has placed each upvote. And the Dot Collector ranks people on a scale from 1 to 10, while upvotes are binary: you can give either +1 or -1. But if you think someone's post is particularly funny, lucrative, or both, you can award them Reddit Gold– kind of like giving someone a high score in the Dot Collector.

Anyone can post on WSB, and because people often post for the lulz, you need a way to work out whether someone is legit. On Reddit this is easy: You can click on their profile, and read all their previous comments and posts.

Since WSBers post screenshots of their portfolios along with their investment theses, scrolling through someone's profile provides a reliable way to assess someone's track record. And you can see what other people think of their track record too. The comments section creates common knowledge– everyone knows what everyone else thinks about a particular post.

All their proof-of-work is there– it only takes a second for the discerning Redditor to work out who is full of shit and who is for real.

As for surfacing people's beliefs about investment decisions– that's literally the point of the entire subreddit. WSB is nothing but a belief surfacing and evaluating machine, but it ranks ideas not only based on how much money they'll make, but how much laughter they'll generate.

By sharing investment due diligences and their portfolios on a public forum with upvoting, gilding, and archived threads, WSB have kinda created a decentralised, Dot Collector of their own, albeit one ruled more by memes than logic.

In one sense, WSB is even better at "believability weighting" than the Dot Collector. As far as I understand, Bridgewater only collects dots live– if you change your mind after a meeting, you can't go back and change your evaluations. But on Reddit, you can go back and comment directly under old threads. In 2019, you might have thought buying $GME in anticipation of a short squeeze is stupid. But 18 months later, you probably have a very different opinion. By upvoting and gilding people who have a good track record, you can reward the farsighted, and show your change-of-heart accordingly.

The best part about WSB? No consensus necessary. Because everyone is investing his own money, there doesn't need to be.

Redditors invest money in proportion to how much they, individually, are "sure" it's the right thing to do. WSB is a decentralised hedge fund, aggregating capital from individuals and allocating it in proportion to how much those individuals believe in their own decisions. Or to use their own lingo: How much they like the stock.

💎👐 🚀🚀🚀

*There is a hurricane of devils in this detail. Group norms: very hard to get right and very very important! If you don’t believe me, just check out Bridgewater’s Glassdoor reviews.

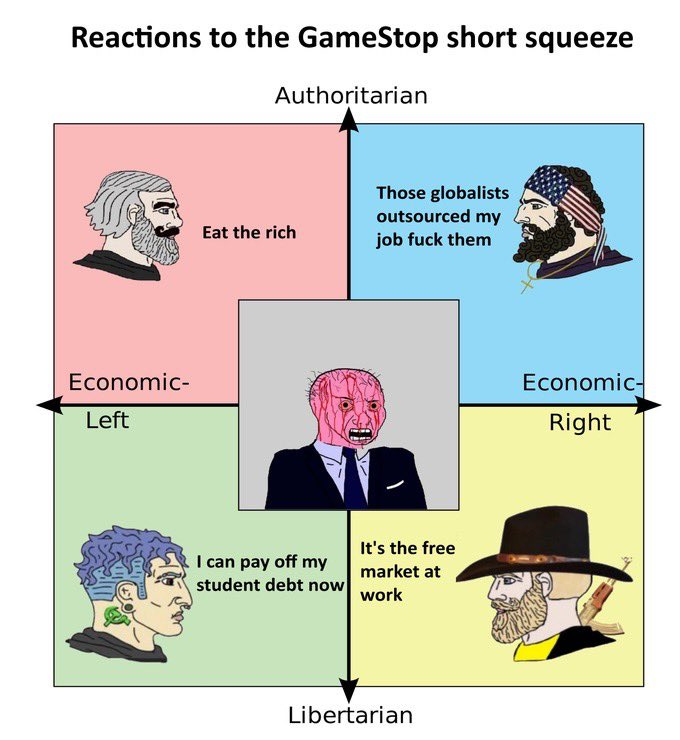

GameStonk has united the political spectrum

To me, the best thing about GameStonk has been how everyone across the political spectrum has gotten behind the Redditors.

Hopefully it shows partisans that there is something everyone can agree on: curbing naked cronyism. I don't know much about financial regulation, so I don't know if or how it should change when this debacle ends. But I do know that it's unfair that retail investors couldn't buy their preferred stonk on Thursday, while large hedge funds could buy shares from the market to cover their shorts as much as they wanted.

💎👐